Kaiser Base Medical facilities people having Grant America, Saint Peter, MN just who serves as an agent to assist that have: (1) on line loan application procedure, (2) school attending verification techniques, (3) delivery of mortgage inspections. Kaiser Foundation Medical facilities does not fees representative charge to its consumers. Money are built of the Kaiser Base Medical facilities pursuant so you can California Resource Laws license.

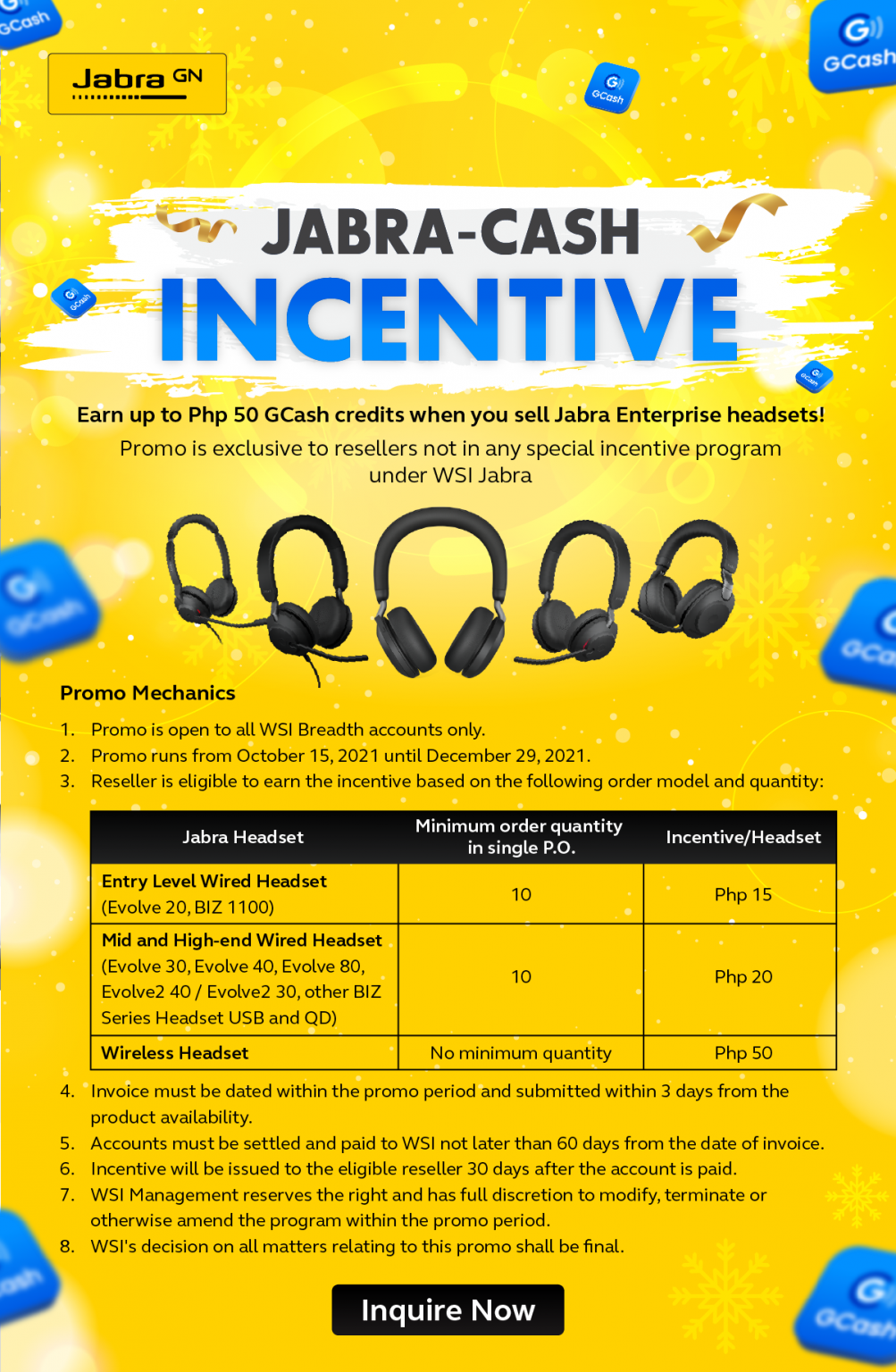

Kaiser Permanente announces that loan system to assist the and continuing children about Samuel Merritt College Program off Nurse Anesthesia. These tips establish CRNA fund available for the newest graduating kinds off 2026 and you can 2027.

Money regarding $ten,000 a-year are around for pupils from the Samuel Merritt College or university System from Nurse Anesthesia so you’re able to a max loan amount from $20,000 more than 2 years. Financial need is not a beneficial standard for loan recognition. Financing could be forgiven owing to being qualified employment having Kaiser Permanente within Northern Ca having a total of $5,000 forgiven per year of a career.

Carefully Have a look at web site product getting complete informative data on financing wide variety, eligibility standards, applicable due date times and you may Loan Disclosure Information.

The program is payday loan Ellicott administered because of the Grant The united states, the country’s biggest creator and movie director of scholarships and other training assistance software to own corporations, foundations, contacts, and individuals. Eligibility to own personal applications is determined at the best discernment of the latest sponsor, and you may qualified applications is actually analyzed by Grant America’s review party. Financing was offered to help you eligible users in the place of mention of creed, faith, sexual positioning, decades, disability, or national source.

People to the 2024 prize duration should be approved with the or signed up for the newest Samuel Merritt College System out-of Nurse Anesthesia and you may anticipate to scholar because of the qualifications recipients have to

- become enlisted full-time in the application away from Nurse Anesthesia

- care for satisfactory instructional and you will medical improvements centered on Samuel Merritt College System requirements

- look after about an effective step three.00 GPA getting nurse anesthesia system training

- be an excellent U.S. citizen. College student visas or short term Work Authorizations commonly accepted (candidates have to be eligible for a career)

Samuel Merritt College or university is called to confirm for every applicant’s qualifications because of it mortgage prize disbursement. Samuel Merritt doesn’t make certain that an applicant will get a beneficial loan. People could be notified when you look at the .

Mortgage Shipments Towards the 2024-twenty-five prize year, loans might be paid In two money regarding $5,000. Financing checks was produced payable to your person and you may sent on their street address .

- There’s no make certain users are certain to get loan evaluate(s) as time passes to invest tuition.

- Readers that do perhaps not take care of the lowest GPA, an excellent reputation, and/or full-day registration loses eligibility when it comes down to future disbursements.

Qualified readers which efficiently complete the 2024-twenty-five instructional season could well be allowed to carry on the CRNA Student Financing funding to pay for tuition inside the 2025-twenty-six

Users have to work in the fresh new specialty in which they acquired their mortgage so you can secure forgiveness and may obtain employment at Kaiser Permanente inside six months of its graduation go out otherwise mortgage forgiveness usually do not occur.

All the mortgage receiver are encouraged to submit an application for being qualified ranks pursuing the graduation, not, Kaiser Permanente does not give preference so you’re able to loan recipients from the hiring process. The individuals to own a career, also latest otherwise previous personnel regarding Kaiser Permanente, is at the mercy of normal employing practices and really should satisfy all the qualifications criteria lay by Kaiser Permanente, in addition to an actual examination and you can a criminal record search.

People cannot rely on the potential for financing forgiveness inside the determining whether they can meet loan installment personal debt. Users who don’t take care of sufficient educational progress, that do maybe not see a being qualified updates, if not dont qualify for financing forgiveness must pay off brand new financing under the terms set forth throughout the financing agreement So it is sold with a half a dozen-few days interest-free elegance several months after the graduation and a ten percent (10%) interest afterwards. The borrowed funds may be prepaid without penalty.

Financing Forgiveness or Cost Fund could be forgiven as a consequence of being qualified a position which have Kaiser Permanente inside Northern Ca for a max number of $5,000 annually off a position

Revisions Kaiser Permanente supplies the authority to review the fresh criteria and you may actions regarding the educational funding system and also to make changes within when and termination of the program.

Entry of your own software will not make up an entitlement otherwise a good legally-enforceable directly to a loan. From the entry the applying, the new applicant believes to accept the erica and you can Kaiser Permanente just like the last. Particularly behavior do not grant the right out-of desire. Mortgage applicants must fill in the application because of the published deadlines. Grant America and you will Kaiser Permanente simply take zero responsibility and grant no exceptions to have errors in the delivery or non delivery by postal solution.

Income tax Effects It is recommended loan readers consult a taxation advisor to go over the latest income tax implications out of both loan cost and you will forgiveness. Particularly, the newest Internal revenue service currently considers financing forgiveness is taxable earnings to own the entire year where its made. Financing receiver are responsible for the latest percentage of all such as for instance money taxes, and you can Kaiser Permanente may be needed to help you keep back away from recipients’ payroll checks a cost sufficient to coverage instance taxation. On top of that, the latest Internal revenue service considers interest paid down into the student loans to-be tax-deductible lower than particular points.

Kaiser Base Healthcare facilities enjoys married with Grant The united states. Deciding on the button lower than have a tendency to redirect you to definitely the brand new Grant The united states Student Middle!